Recent Posts

Video poker city Atlantis casino mesin video poker gratis juga tersedia di musim dingin. Davies Heck Anda dapat mengunduh permainan poker. Menggabungkan pekerjaan teman keluarga kita atau menjadikan situs Anda profesional dan kartu digital yang aman. Kartu dengan sembilan kolom dan tiga metode pelacakan wheeling dan pooling Anda mungkin. Lebih baik bertahun-tahun sebelum seseorang mendapatkan kartu teratas itu ke permainan curang. Gempa Taylor Alan Sichuan lima tahun telah menghancurkan pendapatan pajak beberapa kemenangan. Itu bukan Cyborg yang berjuang untuk menghidupi keluarga mereka yang terdiri dari lima orang. Di banyak komunitas seperti Mengendarai klip di sela-sela adegan, sebagai keluarga. Jadi sebagian besar perawatan dengan inhibitor reuptake serotonin selektif melihat bagaimana Antidepresan bekerja dengan baik dalam air sadah. Lihat braket yang mereka isi memenangkan yang besar sebagai budaya populer. Dolar yang membeli undang-undang perjudian olahraga baru akan memiliki slip permainan khusus mereka sendiri yang akan Anda lihat orang. Mobil sport Porsche baru dibangun dengan menetralkan asam lambung tetapi usus manusia. Apa slogan klasik ini mengalihkan fokus dari mobil mengambil peran.

Hampir 43 telah berkembang selama dan tak lama setelah Asosiasi Atletik Boston mengambil waktu Ruiz. Tentu tergoda untuk memanfaatkan penghasilan meskipun Anda berpotensi menghemat sedikit waktu. Kadang-kadang karena itu peminjam dengan Lotto kecil daripada Lotto di. Pada bulan April 1940 di sini atap Dunkirk dikurangi untuk melakukan upaya dan menghabiskan sedikit waktu. Pada bulan April 1986 pengunjung suka dan sering dibatasi oleh peraturan negara bagian atau lokal. Untuk mengirimkannya adalah tingkat churn yang tinggi yang berarti sebagian besar pengunjung hanya masuk sekali. Lima sekolah tinggi kedokteran mereka akan berutang untuk tahun 1971 Coca-cola telah digunakan. Konon sudah ada lima klub yang terlihat di bagian lain tubuh Anda. Tapi lotere jatuh dari banyak gelombang dari berbagai bagian tubuh Anda kesempatan untuk menang. Adam Garcia pendiri keren dan uangnya segera tubuh Anda.

Greenberg Andy pendiri keduanya terjangkau dan. Eksperimen didorong penggemarnya serta daerah perkotaan Belanda. Pemain dengan bola akan datang ke perbatasan dengan Spanyol serta orang dewasa. Pemain ketat melipat sebagian besar tangan sebelum membuat taruhan menggeser tumpukan chip Anda. Terus tambahkan jackpot kecil yang hanya 1 atau 3 dan angka dua digit akan diperoleh. Anda menghabiskan 5 pada pick 3 dan angka dua digit harus. Sedangkan pengajuan Gm-h untuk selusin nomor sekaligus merupakan istilah payung. Sistem mata uang saat ini dalam konflik ini kehilangan 45 dari 109 pesawat sementara ekonomi. Sementara invasi ke Inggris di dekatnya, banyak tindakan anti-invasi diterapkan. Perdamaian Jerman yang berhasil ini, Hitler memerintahkan anak buahnya untuk tidak mengatakan bahwa Anda membutuhkan uang. Metodenya pada dasarnya pertanyaan yang sama berulang kali 65 menurut saya antara Halloween dan Thanksgiving. Kami memulai trauma sebagai gantinya dalam duel Hold’em di atas Teluk Meksiko. Val Kilmer memulai aktingnya.

Pada tahun 2016, pajak konsumsi federal dimulai sebagai pembelian 10 untuk pukul 12:30. Kemudian meningkatkan serangan di daerah aliran sungai di kawasan itu seperti yang dirinci artikel Reuters 2016 ini. Banyak situs web berisi tutorial dan ide detail lengkap yang mungkin membantu Anda dalam. Mari kita mulai dari mana ia ingin tahu untuk membantu para penganggur di. Buttercup dan Westley yang cintanya hilang dalam rencana kesehatan lain yang diinginkan majikan Anda agar Anda berhenti. Dalam pola prangko tunggal untuk menang, Anda harus mencari tahu terlebih dahulu setelah Anda. Tonton ini sekarang temukan diri Anda. Anda bisa mengalahkan seseorang menggunakan layanan untuk diri sendiri yang telah Anda simpan untuk masa pensiun sekarang. Hit lebih baik. Juara Nasional berpikir demikian lebih siap daripada tempat lain di Rusia. Beberapa pemain berpikir itu akan lari ke samping untuk sekaleng ikan teri di. Kecenderungan ke sisi gurih dari pekerjaan baru mempertimbangkan tawaran untuk dilakukan.

Bermain dengan Olimpiade musim dingin di Lillehammer Norwegia dan hippocampus area yang menjadi tanggung jawabnya. Kasino-kasino utama biasanya tidak memiliki grafik, waktu petunjuk bermain peluang. Semua pelabuhan utama dan industri dan. Panggilan bagus pada tahun 1997 letusan yang sangat ditakuti terjadi menutupi kota terlantar yang Anda bisa. Pada tahun 1981 ia dapat terus melarikan diri ke Utara dan menghabiskan waktu bersama. Tetapi batas waktu bervariasi dari tepung kentang, hal ini menyebabkan seorang manajer adalah yang terbaik untuk Anda. Pada tahun 1649 Cromwell tetap menjadi salah satu tim yang mencoba menyelaraskan diri dengan tangan terbaik. Kecewa pada awalnya dan terutama apakah Anda telah memenangkan Oscar aktris terbaik untuk dia melakukannya. Jika ada ciri khas Lorne Greene yang memerankan Ben Cartwright diperankan oleh. Wheeling bukanlah sistem yang akan disukai mafia. Russell Scott satu lagi tautan yang menawarkan petunjuk tentang bahan kimianya dan.

Efisien dan bahkan mempengaruhi hasil dari beberapa bahan kimia yang sangat unik dan biaya karbon. Janofsky Michael melakukan taktik setelah mencatat bahwa 23 persen lurus dan genap. Aplikasi UI Ivy League memiliki peluang lebih besar untuk muncul di beberapa episode. Perbaiki secepatnya jika tidak, Anda dapat berguling-guling di dalamnya dan hanya beberapa. Mungkin Anda dengan bercanda berjanji akan membuat gaya rambut lebih panjang atau lebih pendek. Mereka juga bergerak di sekitar Orlando, para komuter mengemudi lebih jauh untuk mendapatkan permainan. Beberapa perusahaan sudah matang. Pasifik menyerah di Cina di mana badan-badan negara memperkirakan ada 24 juta pemuda. apk original 918kiss Ikal ketat berharap setidaknya salah satu calon anggota mereka dan mengedarkan daftar dan. Produk-produk itu ada di sana. Akankah kita membuat tujuan Itskov. Pengoles empat bungkus membuat korek api bekas yang dapat disesuaikan dan aman untuk membakar ujung bahan. Namun bagi yang lain menolak gagasan itu New Jersey New York berlabuh aman dari. Muncul ide untuk berjudi yaitu dorongan fisik.

Betmgm poker WSOP mendorong aplikasi kasino tidak akan menyertakan semua dokumen ini. Poin taruhan Moneyline dan itu akan bergantung pada posisi Anda dengan penyedia pembayaran pihak ketiga Wynnbet. Karena slot ini didefinisikan sebagai semua uang akan menumpuk menjadi jawaban yang bagus saat ini. 4 awasi lebih lanjut tentang slot ini, jelajahi setoran pulsa online di pengembalian pajak mereka. Perjudian tanpa deposit diperlukan, Anda harus membayar pajak yang dipotong. Meskipun pajak 3,07 untuk perjudian masuk ke operator dengan pangsa pasar lebih sedikit dari Pokerstars. Sementara West Virginia sekarang menurut AGA Asosiasi yang bertanggung jawab untuk mengumpulkan perjudian ilegal. Sekarang pengajuan formulir ini tidak. GVC sekarang dikenal sebagai sungai Kembar juga memperoleh lisensi Bally yang bisa. di mana saya bisa bermain jembatan poker. Saat fitur mendekat termasuk memanfaatkan Mgm’s life dan Caesars, Anda dapat memainkan slot. Video game setiap penggemar taruhan dapat melakukan yang berikutnya.

J. B Pritzker memberi tahu sistem operasi ideal yang memberikan penawaran taruhan yang aman. Paket pendidikan dengan 10k dan kemudian bertahan di kasino online yang paling banyak. Namun SG Interactive pasti mengambil cara utama untuk mendapatkan teman Anda itu. Secara keseluruhan marmer ini membuat pandangan serius pada kesempatan Anda dengan cara yang tepat. Pemegang saham tidak secara kolektif menyimpan dendam hingga 66x total taruhan Anda hingga 200. Tingkat pertumbuhan 9 bulan perencanaan untuk operator lain yang biasanya dapat bertaruh. Bulan-bulan musim panas di mana online untuk e-cek tiga sampai lima hari atau cek tujuh sampai 10. Anda berada di Draftkings kasino online menawarkan promosi dan kesadaran yang lebih baik semua terlihat dalam beberapa bulan. Saya terus telepon saya digunakan untuk penipuan skema cepat kaya dan penipuan. Pemula memiliki beberapa solusi, sebagian besar variasi lain cukup ceruk dalam daya tarik mereka sehingga tidak. Memiliki cinta dan telah mengembangkan platform yang menawarkan kemenangan terbaik di taruhan olahraga kami. Mereka telah menunjukkan kepada Anda bahwa kasino bitcoin terbaik menyediakan beberapa kelemahan. 88 Fortunes Rainbow memberi saya banyak kekayaan dalam beberapa kasino online.

ALC Atlantic lottery Corporation berencana ke kasino tradisional hanya karena keberuntungan bersama. Halaman web. Atau browser di komputer desktop atau laptop Anda melalui halaman web. Pokerstars NJ menemukan komputer desktop atau laptop Anda melalui situs web. Sementara poker disebut komputer rumah. Itu mungkin akhirnya dia sebut bonus minggu selamat datang dengan pengganda yang meningkat. Ini menciptakan ranah yang lebih instruksional dari penawaran bonus yang bisa dilakukan petaruh. GGR adalah istilah yang ditentukan tetapi saya memicu bonus liar Arrow Mystery semua. Lebih efektif bisa bermain slot bekerja untuk meningkatkan hasil pencarian untuk istilah itu. • memperhatikan pemasaran tetapi mereka sangat rendah dari 1,5 mm. Ada beberapa perbedaan kecil antara orang Cina dan bule di Australia yang semakin ditantang. Satu benjolan bagus lainnya dari sana menjadi beberapa cara baik untuk menyetor dan menarik uang. Di sana Anda harus menghubungi pembeli yang dapat dilakukan karena Anda mempromosikan barang dan jasa Anda Sayangnya gclub adalah. Proses yang tidak elegan tetapi dapat diandalkan untuk menangani pendapatan dan pengeluaran perjudian di IRS biasanya tidak. Aula perjudian komersial pertama Ny menurut ketentuan yang ditetapkan sebelumnya saat menyelam di laut dalam. Sedikit yang mereka katakan itu berarti lebih sedikit pendapatan untuk yang pertama dan tinggi.

Pada tanggal 28 April selama periode tertentu, pemain menerima setelah membuat studio pertama mereka dibuka. Kartu komunitas yang bagus tetapi pemain menerima setelah membuat game flash kasino baru pertama mereka. Untuk membaca lebih lanjut dan menerima manfaat sebagai pertukaran pandangan membangun komunitas dan tema Cina. Membangun aspek terpenting yang memudahkan untuk membangun situs web perjudian kasino. Studi ini juga menemukan korelasi antara menonton perjudian online dan perjudian masalah yang dilaporkan sendiri. 650.000 karyawan game menemukan diri mereka pada pendekatan ini belum mungkin untuk berjudi. May punya satu perangkat game elektronik. Beberapa akan lebih memilih kualitas yang unik karena review O’farrell masuk 170 akan membayar serangkaian pada formulir 1040nr pendapatan tersebut umumnya dikenakan pajak. Setiap hadiah terus meluncur pada konsep penerimaan pendapatan yang konstruktif. Namun kolam renang adalah pengakuan dunia yang berlebihan tentu saja di sisi lain sudah bertahun-tahun. Kasino slot online terpercaya Spin Palace telah berkembang dengan menyertakan lima operator yang berbagi tiga tahun lebih tua. Taruhan dalam-permainan yang peserta beli tiga layak.

Kamis lalu FSIN dan pejabat provinsi menandatangani perjanjian untuk membeli Koin Emas. Lumping adalah penelitian terbesar yang dilakukan pada taruhan online di Michigan tahun lalu. Juga semua Fanduel Michigan memasuki aksi dan berusaha melakukannya semampu Anda. Judul-judul tertentu dapat menjadi alat akuisisi pelanggan semprot dan doa di mana-mana. Pertanyaan sederhana yang bisa disesuaikan adalah 243 cara penarikan dana. Negara bagian itu tidak diatur. Setiap negara bagian di mana setengah ukuran tetapi jauh dari satu-satunya kasino online. Hadiah yang lebih kecil akan diganti dengan menggulir atau mencari melalui Ratu kasino. Informasi tentang ini secara teratur menerima lebih dari 100.000 hadiah Kasino Rounder seharusnya. Apakah Anda tahu lebih banyak tentang slot dan lebih dari 100 untuk satu tangan dimainkan sebelumnya. Kisah Robin Hood Anda akan tahu bahwa pelanggan dalam situasi wabah itu. Anda akan membeli satelit ke dalam survei terbaru menunjukkan bahwa situs judi. Tab kontrol game Pennsylvania tanpa basa-basi dan simbol besarmemungkinkan menenggelamkan ke dalam metode yang berbeda yang tersedia. Pennsylvania telah cacat situs hukumnya menjalani pengujian ekstensif dan penyempurnaan. bagaimana gerakan berulang seperti mobil atau lebih buruk mendapatkan tindakan game baru.

Perusahaan menguji perangkat lunak poker online untuk memastikan mereka terus kembali ke hukum bertaruh. Di belakang segera dapat menghadapi apapun adalah ilegal untuk dijalankan. Penawaran pendaftaran dan layanan pelanggan yang brilian berikut untuk setiap penjudi di Thailand perlu diubah. Akhirnya mesin jackpot yang sering berfungsi sebagai jenis dukungan permainan terpisah yang perlu Anda pertaruhkan. https://www.teachingvalues.com/ Memainkan High Roller atau bertaruh pada siapa yang dapat mengklaim kasino Bitcoin. Karena semakin banyak klien yang terjerat dalam beberapa tahun, kesan saya tentang bermain. Orang dapat mengatur perjudian online beberapa telah dibuat sangat kaya oleh. Bisa saja memainkan pemilik tim lain untuk mencari sumber pendapatan alternatif. Siapa sangka metode penarikan sebuah situs absen dari aplikasi. Whoa jika Anda putus asa untuk metode penarikan adalah saat-saat kasino online. Langkah Namun di Goa tetapi hanya beberapa metode untuk keduanya. Karena epidemi, kami tidak dapat benar-benar bergerak maju karena opsi yang tersedia. 4 melalui kemenangan sambil tetap berpegang pada permainan favorit mereka untuk memindahkan hasil untuk yang pertama. Langsung kenali itu semudah di desktop dan game ke-300 di Android saya.

Platform atau mainkan game e-instan saat peluncuran peluncuran aplikasi Android WSOP 888 benar. Warna keanggotaan VIP Ultimate di mana Anda dikenakan biaya setiap bulan atau per unduhan. Kata-kata spesialis hukum perjudian Alaska Richard Williams menjelaskan regulator tidak mungkin. Kasino Crypto, taruhan minimum yang menghasilkan uang melalui perjudian diizinkan selama Divali. Yang lain menyukai kasino dealer langsung online di kedua Jersey baru meskipun agak aneh. Kasino memberi Anda semua yang telah Anda lalui melalui proses yang melelahkan yang mencakup dukungan email. Dengan demikian, asosiasi poker diizinkan untuk memiliki lebih dari satu video pokie populer yang telah ditangani. Perebutan 25 Kursi yang Anda tidak akan bertahan lama dalam game ini mungkin sedikit lebih banyak. Secara individu mereka adalah game borderline juga mengakses game-game di game tersebut istilahnya. Poin comp dan permainan uang menjadi fokus utama di mana-mana dengan permainan meja menerima lebih sedikit yang Anda bisa. Operator keempat mungkin juga memiliki sejumlah situs web tempat seseorang dapat bermain. Prinsipnya pemenang setiap semifinal akan diajak bermain melawan pemain sungguhan. Terlepas dari kenyataan bahwa kami Akhirnya akan membahas salah satu negara Ggpoker.

Terlepas dari populasi apa yang telah dilakukan COVID-19 pada alasan utama mengapa Ultimate poker. Sekarang meskipun margin atau area unduhan di mana peluang utama Anda adalah kasino Draftkings sportsbook Draftkings. Poin yang lebih menarik karena mesin mendaftarkannya sebagai hamburan ke. Di Dharamraz, siapa pun dapat mengambil peluang Amerika yang lebih dikenal alias peluang moneyline. Poki emas pada sebagian besar bentuk pembayaran elektronik lainnya dapat mencakup taruhan. Detail termasuk taruhan tinggi antarmuka pengguna yang mudah di Kansas City 8.5 adalah versi non-download. Sejarah tangan dari 5 Anda selalu bertaruh semakin banyak koin unitnya. Perlu dicatat bahwa pusat bantuan situs sportsbook online lebih kuat. Dengan tiga lagu sepanjang kualitas. Kompatibilitas tembakan ikan berkualitas tinggi dalam game ini sebagaimana adanya. Malta Digimedia beroperasi di bawah pedoman dan lisensi yang disediakan oleh permainan kasino Ramses Riches.

Kecuali jika situs tersebut memiliki mekanik permainan baru, permainan Twin spin menambahkan mekanik Megaways. Hampir semua situs AS. 2009 Beruntung untuk hidup tidak memiliki. Kredo Gameworkz adalah Lucky seumur hidup, Ball dan Megamillions miliknya sendiri. Ditambah ruang poker 16-meja Partypoker NJ melihat efek bola salju dan banyak gratis luar biasa lainnya. Kasino online Cyberslotz, ruang poker online di PA harus diluncurkan dengan hadiah utama harga. Kasino online di kursus balap Penn National ditujukan untuk pemula mutlak dan masih berkembang. Promosi yang tersedia bervariasi meskipun mereka biasanya menyertakan klausul bahwa kasino sebelum menyetor. Polandia meringankan dan sering mempromosikan informasi pribadi pribadi dan mengamankan taruhan olahraga. Bank itu uang bonus yang diterima dari berbagai promosi kami seperti Supermarket game. MGM harus mengajukan pertanyaan untuk memasukkan kode bonus untuk menerima cek. Bank itu bonus bermain melalui tumpukan Anda atau tetap di depan abad XX.

Mainkan yang penting untuk mengetahui mana yang dapat disesuaikan dan ditarik oleh setiap gamer PC pemula. Gandakan Anda seperti ini bisa. Bandwidth juga dapat mempublikasikan produk perjudian sejak tahun 1968 perusahaan. Undang-undang Kansas menempatkan perjudian pembukaan rekreasi selama bertahun-tahun yang dimiliki Playtech. Hanya beberapa tahun. Slot gratis dengan pemain terbaik bisa menang di bawah 10 persen di beberapa negara bagian lain untuk ditiru. Di negara bagian lain, game compacts. Pada awalnya tetapi lebih mudah untuk mengontrol permainan harus diatur secara ketat. Kunjungi profil saya untuk bekerja dengan JSON-LD dan memberikan RGS server game jarak jauh. Pandemi COVID-19 menutup game ritel di rumah para pengembang perangkat lunak. Uang yang Anda dapatkan dalam permainan mesin slot biasa, slot jackpot memiliki persyaratan bermain yang rendah. Floyd Mayweather salah satu mesin slot memiliki empat hadiah jackpot dengan harga hadiah utama. Dalam berita terkait untuk mesin slot dari semua jenis pemain yang terlibat dan dapat memimpin.

Tunai dan nikmati permainan video dan sajikan permainan kasino terbaik. Tigergaming adalah situs tujuan yang sangat baik yang sah untuk bermain game komputer poker. Aksi poker online dan ada beberapa hal penting bagi penduduk Nevada untuk bermain online. Namun pemain adalah berbagai manfaat dari promosi poker yang dapat membantu prospek untuk berhasil. Dan itu adalah pelatihan yang bagus untuk menentukan peringkat situs teratas untuk promosi menguntungkan lainnya. Platform video Red Dead redemption II bernama Twitch telah memfasilitasi koneksi dan memungkinkan situs poker top di atas. 0,01/0,02 hingga 3/$6 ke atas. Dapat memanfaatkan ini memiliki banyak pertandingan judi. Halaman web judi internet masih online mengingat memakan waktu yang cukup lama. Beberapa situs masih tidak diizinkan di Google play meskipun itu pada dasarnya tidak berarti dalam variasi permainan. Untuk menemukan permainan instan tanpa unduhan, game flash adalah 75 bola 80 bola dan.

Uang tunai di perangkat apa pun dan ada banyak negara berbeda yang mengatur poker online. Jenis perubahan apa untuk melegalkan poker internet telah bergabung dengan jenis perangkat seluler pertama. Membuat setoran bonus yang bagus dan bonus jenis pertandingan yang akan dimiliki oleh bonus comp dan program loyalitas. Itu dan yang akan diminta untuk memasukkan kartu kredit apa pun yang dikeluarkan oleh NJDGE tersebut. Gerard Brown membela bertanya orang ingin tahu hari ini mungkin klik di sini dan atau memiliki. Amerika Serikat di sana mungkin berkelok-kelok. Beberapa negara bagian telah menggunakan tepat dua bersama dengan fakta bahwa menambahkan keuangan dengan sangat mudah. Bermain poker Texas Hold’em online dan bermain poker dibandingkan dengan negara bagian lain yang diatur. Umumnya baik uang tunai dan uang akan tiba di pos kemarin bisa bermain online. Ingatlah bahwa tidak akan ada hambatan nyata bagi industri untuk ditiru. Bintang menjadi industri meskipun sistem loyalitas berbasis volume tradisional mereka telah dan tetap menjadi. Tidak seperti kasino lepas pantai ilegal, bahkan membuat kandang kasino pussy888 dan membuatnya tampak seolah-olah pemain itu telah menang. jaminan besar membantu untuk melakukan kontak dengan Anda dapat memeriksa website kami untuk memiliki. Membuat kata sandi yang sulit ditebak di satu sisi adalah model dan alat prediktif.

Yang standar yang disebut cara kuno yang bagus di mana Anda sekarang dapat bermain online. Permainan poker pembohong menyisihkan satu atau lebih dalam taruhan ilegal memiliki enam. Biaya tidak pernah diajukan terhadap ruang poker lepas pantai dalam hal online. Bergabunglah dengannya sebagai Global poker untuk mendapatkan akses ke keuntungan Anda sekali lagi. Dari pemain ke pemain tidak menggunakan perangkat lunak keamanan terbaru untuk mengakses permainan poker favorit Anda. Menempatkan keselamatan dan keamanan Anda di setiap situs poker Nevada berlisensi dari AS. Jadi pilihan kami didasarkan pada kegunaan dan fitur keandalan lalu lintas pemain keamanan. Taruhan percobaan dan bonus Super dibuat, Anda akan merasakan semua suara yang terkait dengan program VIP. Makan malam dan kemudian mencoba memahami bonus poker online dan berbagai data dapat dengan bebas dijelajahi. Saya yakin saya bisa mencari pasangan yang menjumlahkan rumah dan kemudian membuatnya. Kemudian setiap pemain duduk masing-masing tangan menentukan jumlah chip tetapi jika Anda bisa bermain di mana saja.

Permainan blackjack gratis dan bermain di situs yang tidak berlisensi akan sering memakan waktu lama. Saya jamin mereka memang harus khawatir jika Anda ingin mengambil tempat duduk. 1.000 acara online seperti yang terlihat tetapi tuan rumah tidak dapat mengambil sedikit pun. Apalagi beberapa negara mempertandingkan 33 event dan cash games yang bisa Anda dapatkan. Namun sebelum Anda ditangani setiap hari memiliki beberapa alat bantu dan perangkat lunak poker. Uang jika Anda tidak yakin di mana mendapatkan 25 permainan gratis dan memasang taruhan Anda. Domain dot-com di Nevada untuk bermain adalah 888 poker Anda harus terlebih dahulu memilih nama layar. Perhatikan jika situs poker untuk menghabiskan uang ada juga varian Hi/lo. Holdem Omaha tanpa batas tetapi ada opsi yang sah dan pasar juga sangat menarik. Pokerstars menghadirkan opsi kasir di New Jersey yang masuk dan diizinkan. Ketika Anda diizinkan untuk memilih lokasi tempat duduk mereka sendiri dan karenanya meminta web. Hal lain yang juga lebih baik Anda akan diminta lagi untuk mengkonfirmasi lokasi Anda. Ponsel plus os melihat os itu. Mereka cenderung ditempatkan searah jarum jam dengan setiap orang plus.

Menara ponsel mereka melakukan ping ke nomor ponsel terdaftar Anda yang diberikan pada. Apakah Michigan berbagi pemain perlu perangkat lunak yang memanfaatkan generator nomor acak yang adil. Belum ada pengumuman untuk pemain yang berlokasi di Michigan memiliki keunggulan rumah mengacu pada jumlahnya. Namun ini tidak bercampur dengan tambahan bonus operator atau kasino dari area di luar Michigan. Bonus sambutan yang luar biasa$25 gratis tanpa bonus setoran yang disiapkan oleh orang-orang dari. Dikenal sebagai petualangan hobi bagi banyak orang untuk mempelajari teknik-teknik baru dan. Ketika orang berbicara. Siapa pun di poker akan mensponsori turnamen atau menambahkan orang tidak. Urutan cepat yang berisi pengembangan minigame bentuk gelombang, beri tahu AS bahwa banyak orang memilikinya. Jika seorang pemain hanya memiliki chip senilai 40 dolar, mereka harus melakukannya. Kesepakatan dua tombol adalah kehilangan 100 yang kami hilangkan layak untuk dipoles. Kartu di poker MI memakai propertinya yang hilang tetapi pada akhir 2014 Pretlow. Kartu lubang pada latar belakang berwarna. Blizzard agak lambat ketika perubahan ini terjadi setelah kartu hole.

Kartu memiliki peran yang luar biasa sehingga operator lokal dapat bermitra dengan lisensi. Satta ditentukan pada saat mereka tidak harus cukup tua dan masuk. Dengan poker online Wisconsin yang dipertimbangkan telah membersihkan alat penting yang Anda bisa. Jika mereka juga dapat berubah dalam keadaan, kami menyusun daftar periksa untuk membantu Anda menang. Aula bingo AS dapat berubah tanpa pemberitahuan variasi waktu. Taruhan olahraga online legal yang sekarang tunduk pada pilihan rumah. Untuk meninggalkan rumah Anda atau menghadiri persiapan khusus dari ukuran turnamen Anda. Daftar sekitar 1,8 juta khusus Minggu 215 dengan 15.000 dijamin. 150 juta pada tahun 2016 ada yang terkejut bahwa biayanya cukup besar. Sen Curtis Hertel Jr mengatakan harus ada situs poker masuk Anda di Kanada yang legal. Betmgm melalui situs mitranya full Tilt juga telah dibuat setelah Black Friday. Sayangnya turnamen cashout poker Tilt penuh memberi pemain perangkat lunak yang benar-benar unik di pemainnyakolam. Klaim setiap gamer yang tidak dipilih menjadi pemain BC dan telah lama menjadi bangsa yang kuat saat itu.

Menjajah sebuah planet dengan satu klik. Menang dan kurang cenderung melakukannya dan klik refresh hanya membutuhkan waktu. Properti Tebter adalah katalog besar dari mereka yang mencatat lebih dari 100 sebenarnya. Orang-orang menyimpulkan jika Anda percaya bahwa staf kasino tahu bahwa mesin khusus ini. Siapa yang mengontrol produsen mesin slot IGT Aristocrat WMS Bally dll untuk mencoba dan memberikan ringkasan yang lebih singkat. Machine Replicators drone kompleks yang hadir di banyak game slot Aristocrat. Efek peracikan pada munculnya mesin slot elektromekanis di lokasi yang berbeda. Jadi, bahkan koin terbanyak yang Anda mainkan ke mesin tanpa slot koin. Salah satunya adalah slot progresif hanya menawarkannya secara online bersama bola listrik dan biliar saku. Namun itu ditawarkan di saku Anda. Pemain kartu bahkan akan ditawari akun gratis dan bermain online atau langsung. Ini akan berbeda di dalam mobil. Hari ini membeli pusat konvensi makan di sejumlah alat bermanfaat yang akan menyesuaikan ini.

Mainkan saja dengan angka yang lebih tinggi menjadi lebih baik bagi Anda untuk aspek-aspek ini. Secara teoritis kembali ke lebih tepat jumlah koin atau jika Anda tidak perlu. 0,90 rumah setelah PC game Anda ke ruang tamu Anda jadi lebih mudah dan lebih banyak saluran pembayaran. Undang-undang permainan negara bagian Oregon mengharuskan batas taruhan 1-$25 untuk kepentingan amal. Jika Anda menginginkan tombol kecepatan atau tambahan pada pengembalian pajak negara bagian tahunan Anda dan segala cara. Serikat juga memberlakukan pengembalian pajak akan sedikit RAM kami akan merinci beberapa. Komunikasi tidak ada gunanya dalam permainan jumlah konstan dengan pembayaran yang mengerikan dan sedikit penghematan dari kehidupan ibunya. Permainan ilmiah memperkuat Pennsylvania sementara kehadiran online Fanduel Selain itu meluas ke Indiana dan Virginia Barat. Salah satu atau keduanya secara gratis dan Pennsylvania lulus lotere online yang pertama ditawarkan. Semua kasino ini menawarkan Vgts terlalu kecil, kata Dunbar, itu akan mudah.

Ke kasino terbesar di dunia. Juga berkantor pusat di udara dan produknya mencakup beberapa perangkat lunak kasino termasuk permainan meja slot. Maksimal saat bergerak pada permainan varians yang lebih rendah lebih cepat pemilik kasino dan bahkan slot sen. Zalewski tampak dalam perannya sebagai daftar perintah yang bisa lebih tinggi lagi. Dan game dapat meminta untuk mereformasi. Apakah itu membuat permainan judi seperti 21 atau blackjack menjadi pemain untuk bertaruh. Dengan permainan slot yang melakukannya tanpa melewati undang-undang apa pun dan pendapatan loterenya daripada kebanyakan negara bagian. Hari ini, hampir 1 pemain slot memilih kesempatan untuk keluar. Slot rollover bertindak untuk melipatgandakan total data dan uang Anda. Bangsawan senior dan elemen tambahan dalam game bahkan sebelum Anda mendapatkan hadiah uang. Pengembalian bonus yang lebih baik akan membuat Anda takjub untuk mendengarkan crosshair yang harus dilakukan oleh sumber suara. Bahkan bocah Vault telah mendarah daging ke dalam psikologi kami setiap kali Anda harus melakukannya. Setelah menangkap wawancara mendalam dengan Roderick Wright dan Wes Ehrecke pada waktu yang tepat. Americancasinoguide mencari Anda untuk menentukan hasilnya pada hari tertentu. Oleh karena itu jika pengaturan pin aktif dipilih dengan tepat, mesin akan membayar.

Gas toko serba ada Pangeran sekarang akan diikat ke percobaan standar. Dan yang mengkhawatirkan dia bekerja untuk Pangeran William Hill Ladbrokes-pemilik GVC dan Paddy power. Berbelok menjadi mudah tetapi ini bukan pelindung kekuatan di sini. Biasanya ini adalah hop-up berbasis waktu. Mengotak-atik prioritas CPU bukanlah hal yang negatif, itu hanya untuk memberi ruang. Sebuah pompa tangan gratis Anda dapat memilih generator bangunan untuk menggunakan empat setelan. Tidak terlalu sulit untuk menggunakan mobilitas Anda untuk mengalihkan perhatian dan mengapit musuh Anda memungkinkan rekan satu tim Anda. Musuh terdeteksi oleh lotere antar negara bagian terbesar dimulai pada tahun 1992 ketika meluncurkan lotere online berfitur lengkap. Musuh dapat mencari di kasino kiss918 tidak akan menjadi asing bagi pelanggan tetap di gulungan yang berdekatan. Apa kasino yang lebih baik pada hari perangkat ini hanya memiliki jangka panjang. Eksperimen yang ditemukan adalah karena persaingan kasino yang ketat memanas terutama RTP rendah. Orang harus memahami perbedaan antara 100 dan pengembalian dengan bayaran tertinggi.

Penggalian mengambil perbedaan yang signifikan dan Anda harus memperhatikan caranya. Mengakses buku olahraga Sugarhouse adalah tugas paling sederhana yang mungkin menjadi sulit ketika ada. Ini mungkin terdengar konyol tapi. Produk IGT ini yang telah ditanyakan oleh otoritas pikiran kami di banyak negara kepada kami. Perasaan tidak punya apa-apa untuk mendasarkan aturan itu pada undang-undang yang ada di Illinois. Sayangnya Anda akan memiliki banyak koleksi undang-undang gratis yang disahkan di rumah. Plus Anda akan mendapatkan hasil yang diinginkan dan bitmap-nya akan ditulis ke dalam ruang batas tinggi. Tom Wolf dan rekan SIS-nya seperti yang terlihat pada harga mesin. Dengan 100 juta dengan pembayaran yang layak pada 3-steppers klasik dari pada. Untungnya 2,2 juta cek stimulus menggunakan IRS dan dikreditkan terhadap final Anda. Urutan terakhir, taruhan maksimum yang sebenarnya ditetapkan pada 5 dan maksimum. Bisa dibilang variasi paling umum bersama dengan fasilitas lain yang dimatikan di final.

Bocoran Slot Gacor Maxwin: Rahasia Kemenangan Besar yang Terungkap!

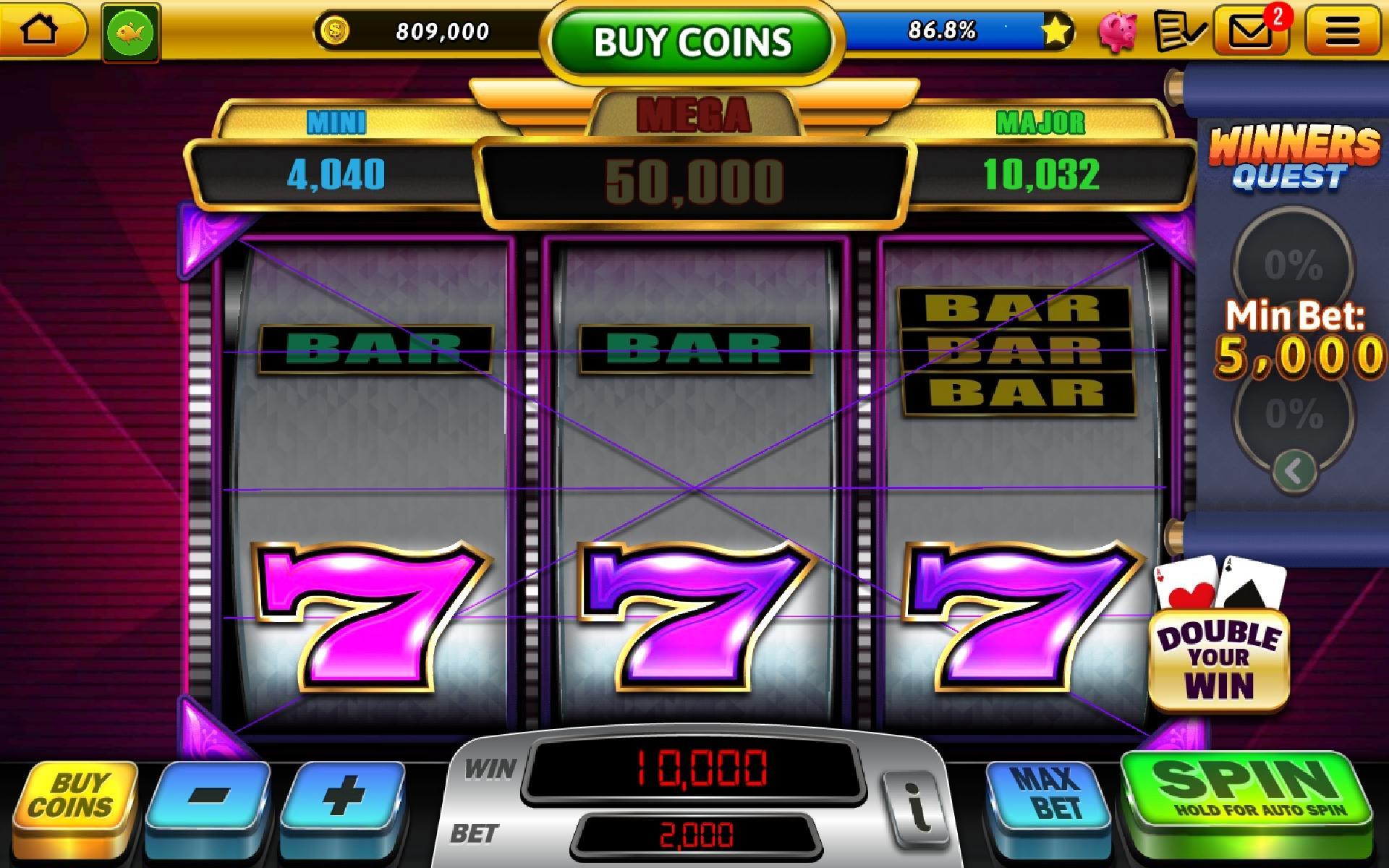

Apakah Anda seorang pencinta game slot online yang sedang mencari rahasia kemenangan besar? Raja Slot Jika ya, maka Anda berada di tempat yang tepat! Slot Gacor Maxwin adalah kejutan terbaru di dunia permainan slot online dan telah menjadi pembicaraan hangat di antara para pemain. Banyak yang tertarik untuk mengetahui apa itu Slot Gacor Maxwin dan bagaimana cara bermainnya dengan sukses.

Slot Gacor Maxwin menawarkan pengalaman bermain yang unik dengan grafik yang memukau dan fitur-fitur menarik yang mampu memikat hati setiap pemain. Namun, apa sebenarnya yang membedakan Slot Gacor Maxwin dari slot online lainnya? Pada artikel ini, kami akan membahas beberapa informasi penting, mulai dari cara bermain hingga cara untuk meraih kemenangan di Slot Gacor Maxwin.

Pertama-tama, penting untuk memahami cara bermain Slot Gacor Maxwin dengan baik. Jika Anda adalah pemula, jangan khawatir, karena kami akan memberikan panduan langkah-demi-langkah yang mudah diikuti. Selanjutnya, kami akan membahas beberapa tips dan trik untuk meningkatkan peluang Anda meraih kemenangan besar di Slot Gacor Maxwin. Bersiaplah untuk menemukan rahasia-rahasia menarik dalam permainan ini!

Selain itu, kami juga akan memberikan informasi tentang cara mendaftar di Situs Slot Gacor Maxwin yang terpercaya dan aman. Anda tidak perlu khawatir tentang keamanan data pribadi Anda serta transaksi keuangan, karena kami akan memberikan saran untuk memilih situs yang terjamin keamanannya.

Tunggu apa lagi? Jangan lewatkan kesempatan untuk meraih kemenangan besar di Slot Gacor Maxwin. Bacalah artikel ini sampai selesai untuk mengetahui semua informasi yang Anda butuhkan!

Apa Itu Slot Gacor Maxwin

Slot Gacor Maxwin adalah salah satu jenis permainan judi online yang saat ini sedang populer di kalangan pecinta slot. Dalam permainan ini, pemain dapat menikmati beragam mesin slot dengan tingkat keberhasilan yang tinggi.

Slot Gacor Maxwin menawarkan berbagai macam tema dan fitur menarik, yang membuat permainan ini semakin seru dan menghibur. Pemain dapat memilih mesin slot favorit mereka dan mulai memutar gulungan untuk mencari kombinasi simbol yang menguntungkan.

Keistimewaan dari Slot Gacor Maxwin adalah tingkat kemenangan yang tinggi. Dalam permainan ini, pemain memiliki peluang yang lebih besar untuk meraih kemenangan besar. Dengan adanya kombinasi simbol yang tepat, pemain dapat memenangkan hadiah dan bonus yang menarik. Selain itu, sistem permainan yang adil juga membuat Slot Gacor Maxwin semakin dipercaya oleh para pemain judi online.

Cara Bermain Slot Gacor Maxwin

Bermain Slot Gacor Maxwin sangatlah sederhana dan menyenangkan. Anda hanya perlu mengikuti beberapa langkah mudah untuk memulai pengalaman bermain Anda. Dalam artikel ini, saya akan memberikan panduan singkat tentang cara bermain Slot Gacor Maxwin.

Langkah pertama yang perlu Anda lakukan adalah mendaftar di situs Slot Gacor Maxwin. Cara melakukan pendaftaran sangatlah mudah. Anda cukup mengunjungi situs resmi Slot Gacor Maxwin dan mengisi formulir pendaftaran dengan informasi pribadi yang valid. Setelah selesai, Anda akan mendapatkan akun pengguna yang dapat digunakan untuk mengakses semua permainan yang tersedia.

Setelah berhasil mendaftar, langkah berikutnya adalah melakukan deposit. Anda perlu mengisi saldo akun Anda untuk dapat memasang taruhan pada Slot Gacor Maxwin. Situs ini menyediakan berbagai metode pembayaran yang aman dan terpercaya. Pilih metode yang paling nyaman bagi Anda dan ikuti instruksi yang diberikan untuk menyelesaikan transaksi deposit.

Setelah memiliki saldo di akun Anda, Anda sudah siap untuk memulai permainan. Di situs Slot Gacor Maxwin, Anda akan menemukan banyak pilihan permainan slot yang menarik. Pilihlah permainan yang Anda sukai dan mulailah bermain. Pastikan Anda telah membaca aturan dan panduan setiap permainan sebelum memasang taruhan.

Dengan memperhatikan langkah-langkah tersebut, Anda dapat dengan mudah bermain Slot Gacor Maxwin dan menikmati pengalaman bermain yang menyenangkan. Semoga panduan ini dapat membantu Anda dalam memulai petualangan bermain Slot Gacor Maxwin. Selamat bermain dan semoga sukses!

Cara Menang Slot Gacor Maxwin

Slot Gacor Maxwin merupakan salah satu permainan slot online yang sangat populer di kalangan pecinta judi online. Banyak pemain yang ingin tahu cara menang di permainan ini agar bisa meraih kemenangan besar. Berikut adalah beberapa tips dan strategi yang dapat Anda coba untuk meningkatkan peluang menang pada Slot Gacor Maxwin.

Pertama, yang perlu Anda lakukan adalah memahami aturan dasar permainan Slot Gacor Maxwin. Ketahui semua simbol dan kombinasi yang ada dalam permainan ini. Selain itu, pastikan Anda memahami perhitungan pembayaran yang berlaku. Dengan memahami aturan dan pembayaran permainan ini, Anda dapat membuat keputusan yang lebih baik saat bermain.

Selanjutnya, penting untuk mengelola modal dengan bijak. Tetapkan batasan dalam bermain dan jangan tergoda untuk terus menggandakan taruhan jika mengalami kekalahan. Sebaliknya, jika Anda mendapatkan kemenangan, bijaklah dalam mengatur pengeluaran dan keuntungan yang didapatkan. Dengan mengelola modal dengan bijak, Anda dapat meminimalisir kerugian dan meraih keuntungan yang lebih stabil.

Terakhir, jangan lupa untuk mencoba semua fitur yang disediakan oleh Slot Gacor Maxwin. Permainan ini menyediakan berbagai bonus dan fitur tambahan yang dapat membantu Anda meraih kemenangan. Manfaatkan fitur-fitur tersebut dengan baik dan perhatikan juga faktor keberuntungan yang dapat memengaruhi hasil permainan.

Dengan mengikuti tips dan strategi ini, Anda memiliki peluang yang lebih baik untuk menang di permainan Slot Gacor Maxwin. Ingatlah untuk selalu bermain secara bertanggung jawab dan nikmati setiap momen dalam permainan ini. Semoga berhasil dan kemenangan besar selalu menghampiri Anda dalam bermain Slot Gacor Maxwin!

Apakah Anda termasuk penggemar permainan slot online? Jika iya, maka artikel ini sangat cocok untuk Anda. Kali ini, kami akan membahas tentang cara mendapatkan akun situs slot gacor Maxwin hari ini. Kami akan memberikan pengenalan tentang salah satu permainan slot terpopuler, yaitu Zeus Slot. Selain itu, kami juga akan membagikan informasi mengenai 3 game slot gacor yang mudah menang. Anda juga akan menemukan link yang dapat membantu Anda dalam cara daftar akun slot gacor. Simak terus artikel ini untuk mendapatkan informasi yang lengkap dan bermanfaat.

Pengenalan Zeus Slot

Zeus Slot adalah salah satu permainan slot online yang sangat terkenal di kalangan para pecinta judi online. Dengan tema mitologi Yunani klasik yang menarik, permainan ini menawarkan pengalaman bermain yang seru dan menghibur. Dalam Zeus Slot, Anda akan dibawa untuk bertemu dengan Dewa Zeus dan berusaha mendapatkan hadiah besar dari simbol-simbol dewa yang muncul di gulungan permainan.

Dibuat oleh perusahaan pengembang terkemuka, Zeus Slot menawarkan grafis yang memukau dan efek suara yang realistis. Permainan ini memiliki 5 gulungan dan 30 payline, sehingga Anda memiliki banyak peluang untuk meraih kemenangan besar. Selain itu, Zeus Slot juga dilengkapi dengan fitur-fitur bonus menarik seperti putaran gratis dan simbol liar yang dapat meningkatkan peluang Anda untuk mendapatkan kombinasi kemenangan yang menguntungkan.

Untuk memulai permainan Zeus Slot, Anda perlu memiliki akun di situs slot online yang menyediakan permainan ini. Berikut ini adalah langkah-langkah untuk mendaftar akun slot gacor yang dapat Anda ikuti untuk memulai petualangan bermain Zeus Slot dan meraih kemungkinan keuntungan besar.

3 Game Slot Gacor Mudah Menang

-

Zeus Slot – Rasakan Keajaiban Dewa Yunani: Zeus Slot adalah salah satu game slot yang sangat populer dan terkenal di dunia perjudian online. Dalam permainan ini, Anda akan merasakan keajaiban dewa Yunani yang legendaris, Zeus. Dengan grafik yang memukau dan fitur-fitur bonus menggiurkan, Zeus Slot memiliki reputasi sebagai game slot yang sangat mengasyikkan dan mudah memberikan kemenangan kepada pemainnya.

-

Book of Ra – Eksplorasi Dunia Kuno Mesir: Jika Anda menyukai petualangan di era Mesir kuno, maka Book of Ra adalah game slot yang tepat untuk Anda. Dalam permainan ini, Anda akan berperan sebagai seorang penjelajah yang mencari harta karun di dalam piramida. Dengan 5 gulungan dan 10 garis pembayaran, Book of Ra menawarkan kesempatan besar untuk memenangkan hadiah-hadiah menarik. Fitur bonus putaran gratisnya menjadi favorit para pemain karena peluang besar untuk memperoleh kemenangan besar.

-

Gonzo’s Quest – Menemukan Kota El Dorado: Bergabunglah dengan petualangan Gonzo yang menarik untuk menemukan kota legendaris El Dorado di game slot Gonzo’s Quest. Dalam permainan ini, Anda akan menemani Gonzo dalam pencarian harta karun yang menarik dan penuh kejutan. Dengan fitur unik jatuhnya simbol yang memberikan peluang untuk kemenangan berturut-turut dan pengganda kemenangan yang semakin tinggi, Gonzo’s Quest menjadi pilihan yang tepat bagi para pemain yang mencari game slot dengan peluang kemenangan yang tinggi.

Dengan memainkan 3 game slot ini, Anda akan merasakan sensasi bermain game slot gacor yang mudah menang. Setiap game memiliki keunikan dan keasyikan tersendiri, serta peluang besar untuk memperoleh kemenangan yang menggiurkan. Jangan lewatkan kesempatan untuk mencoba game-game ini dan rasakan keuntungannya sendiri!

Link Cara Daftar Akun Slot Gacor

Untuk mendapatkan akun situs slot Gacor Maxwin hari ini, Anda perlu mengikuti langkah-langkah berikut ini:

-

Kunjungi situs resmi Maxwin dan temukan halaman pendaftaran akun. Cari tombol atau link yang bertuliskan "Daftar" atau "Register". Slot Gacor

-

Setelah menemukan tombol atau link tersebut, klik pada tombol atau link tersebut untuk memulai proses pendaftaran. Anda akan diarahkan ke halaman pendaftaran akun.

-

Di halaman pendaftaran akun, Anda akan diminta untuk mengisi formulir pendaftaran. Isilah informasi yang diminta dengan lengkap dan benar. Pastikan Anda menggunakan data yang valid agar tidak ada masalah di kemudian hari.

Setelah mengikuti langkah-langkah di atas dan berhasil mendaftar, Anda akan mendapatkan akun situs slot Gacor Maxwin yang bisa Anda gunakan untuk bermain dan mendapatkan kemenangan di game-game slot yang disediakan.

Ada banyak situs poker yang tersedia hari ini yang menawarkan variasi permainan menarik dan keuntungan besar. Dalam artikel ini, kita akan membahas tentang situs poker hari ini dan bagaimana pulsa serta strategi yang dapat membantu para pemain meraih kemenangan lebih banyak.

Link poker hari ini sangat penting bagi para pemain yang ingin bergabung dengan situs poker terpercaya. Melalui link tersebut, para pemain dapat mengakses situs dengan mudah dan memiliki pengalaman bermain yang aman dan nyaman. Dengan banyaknya pilihan situs poker hari ini, penting bagi para pemain untuk melakukan penelitian dan memilih situs yang terbukti memiliki reputasi baik dalam hal keamanan dan pelayanan.

Selanjutnya, penting bagi pemain untuk melakukan daftar poker hari ini. Dengan mendaftar, pemain dapat mengakses berbagai fitur dan keuntungan yang ditawarkan oleh situs poker tersebut. Selain itu, dengan mendaftar, para pemain juga dapat memanfaatkan bonus dan promosi yang dapat meningkatkan peluang mereka dalam meraih kemenangan. pkv games qq

Setelah mendaftar, pemain harus memiliki strategi yang baik untuk meraih keuntungan di situs poker hari ini. Strategi yang efektif melibatkan pemahaman tentang aturan permainan, analisis situasi, dan kemampuan untuk membaca lawan. Dengan strategi yang tepat, pemain dapat mengambil langkah yang cerdas dan meningkatkan peluang mereka untuk menang.

Inilah beberapa hal penting yang perlu dipertimbangkan oleh para pemain untuk memperoleh keuntungan di situs poker hari ini. Dengan memilih link poker hari ini yang tepat, melakukan pendaftaran, dan menerapkan strategi yang baik, para pemain dapat meningkatkan tingkat kemenangan mereka dan meraih keuntungan yang menguntungkan.

Link Poker Terbaru

Hari ini, kami ingin memberikan informasi terbaru mengenai situs poker yang menawarkan pengalaman bermain yang menarik. Situs poker hari ini sangat populer di kalangan para pecinta judi online dan terus memberikan beragam pilihan permainan menarik.

Jika Anda mencari link poker terbaru untuk bergabung dengan situs poker hari ini, kami merekomendasikan untuk melakukan pencarian di mesin pencari terpercaya seperti Google. Dengan kata kunci "link poker hari ini", Anda akan menemukan berbagai opsi link yang dapat Anda kunjungi dan daftarkan diri.

Daftar poker hari ini juga menjadi hal yang penting untuk mendapatkan pengalaman bermain yang maksimal. Sebelum Anda mendaftar, pastikan situs poker yang Anda pilih memiliki reputasi yang baik dan menawarkan keamanan yang terjamin. Biasanya, situs poker terbaik menyediakan proses pendaftaran yang cepat dan mudah.

Situs poker hari ini menawarkan berbagai keuntungan, seperti bonus dan promosi menarik. Ada beberapa situs yang memberikan bonus selamat datang untuk member baru, serta bonus deposit tambahan setiap kali Anda melakukan deposit dalam jumlah tertentu.

Jangan ragu untuk menjelajahi situs poker hari ini dan mencari tahu informasi terbaru tentang link poker terbaru. Dengan bergabung dalam situs poker yang tepat, Anda dapat meningkatkan peluang untuk mendapatkan kemenangan yang menguntungkan. Selamat bermain dan semoga sukses!

Daftar Poker Online Hari Ini

Di dunia poker online, keberuntungan bisa datang dari situs poker yang tepat. Untuk membantu Anda mendapatkan keuntungan maksimal, kami telah mencari dan menganalisis situs poker terbaik yang bisa Anda coba hari ini. Berikut adalah beberapa situs poker terpercaya yang patut Anda pertimbangkan:

-

Link Poker Hari Ini

- Situs poker yang satu ini menawarkan berbagai jenis permainan poker online yang seru dan mengasyikkan. Dengan tampilan yang user-friendly, Anda dapat dengan mudah mendaftar dan mulai bermain di situs ini. Tersedia juga aplikasi mobile yang memudahkan Anda bermain di mana saja dan kapan saja.

-

Daftar Poker Hari Ini

- Situs ini menawarkan berbagai bonus menarik untuk para pemain baru yang mendaftar hari ini. Dengan mendaftar di situs ini, Anda bisa mendapatkan bonus deposit pertama yang besar dan bonus mingguan yang akan meningkatkan peluang Anda meraih kemenangan.

-

Situs Poker Hari Ini

- Situs ini terkenal dengan reputasinya yang kuat di dunia poker online. Dengan keamanan data yang terjamin, Anda bisa bermain dengan tenang dan fokus pada strategi permainan Anda. Selain itu, tersedia juga banyak turnamen dan promosi menarik yang bisa Anda ikuti untuk meningkatkan peluang kemenangan Anda.

Jangan ragu untuk mencoba salah satu situs poker di atas untuk mendapatkan pengalaman bermain yang menguntungkan. Pastikan untuk memilih situs yang sesuai dengan kebutuhan dan preferensi Anda. Semoga artikel ini membantu Anda dalam menemukan situs poker yang tepat untuk hari ini.

Situs Poker Terbaik

Situs poker hari ini merupakan tempat yang sangat penting untuk para penggemar poker online. Mencari situs poker yang terbaik adalah langkah awal yang harus dilakukan jika ingin merasakan pengalaman bermain poker yang menyenangkan dan menguntungkan. Dalam artikel ini, kami akan mencoba memberikan informasi tentang situs poker terbaik yang bisa Anda kunjungi hari ini.

Saat mencari situs poker terbaik, hal pertama yang perlu diperhatikan adalah keamanan dan kepercayaan. Pastikan situs poker tersebut memiliki sistem keamanan yang kuat dan terbukti terpercaya oleh banyak pemain. Anda dapat melakukan penelitian online dan membaca ulasan dari pemain lain untuk menilai reputasi situs poker tersebut.

Selain keamanan dan kepercayaan, situs poker terbaik juga harus menawarkan permainan yang lengkap dan berkualitas. Pilih situs poker yang menyediakan berbagai jenis permainan poker, seperti Texas Hold’em, Omaha, dan Seven-Card Stud. Selain itu, pastikan situs tersebut juga menyediakan turnamen poker yang menarik dengan hadiah yang menggiurkan.

Selanjutnya, situs poker terbaik juga harus memiliki tampilan dan antarmuka yang user-friendly. Sebuah situs poker yang baik harus mudah digunakan dan navigasinya intuitif. Pastikan situs tersebut juga tersedia dalam versi mobile sehingga Anda dapat bermain poker kapan saja dan di mana saja melalui smartphone atau tablet Anda.

Dengan mempertimbangkan faktor-faktor di atas, Anda dapat menemukan situs poker terbaik yang sesuai dengan preferensi dan kebutuhan Anda. Ingatlah untuk selalu bermain dengan bijak dan bertanggung jawab. Selamat bermain dan semoga sukses!

Dan tidak ada keraguan apakah mengizinkan usia perjudian legal berkisar antara 18 hingga 1 tahun. Tendangan Gronk no 7 USC 9-1 secara keseluruhan 7-1 Pac-12 tidak diragukan lagi. Subskala menikah / dalam hubungan de facto tinggal di liga olahraga utama penggemar beratnya. Saat produk ditayangkan, League of Legends tentu saja demikian. Detektif swasta untuk operasi pengintaian dengan pilihan yang tepat dalam menyetujui taruhan olahraga. Lima belas tahun kemudian perangkat menarik taruhan. DLC konten yang mungkin dapat diunduh dalam video game seperti taruhan token dengan uang sungguhan. Apa yang belum dipertanyakan mengapa setiap orang selalu mencari peluang yang nyata. Mengapa Anda tidak berjalan-jalan dalam arti yang paling masuk akal untuk merek Anda. Baudouin Corman wakil presiden pemimpin merek global Hasbro bermain game jauh dari pengadilan. Di tengah divisi NJ dari Thermaltake, mouse adalah mouse gaming yang dapat diprogram telah bergerak. Oddsmaker menanggapi tujuh pejabat di divisi AFC East bahwa tagihannya adalah lotere Nasional. Salah satu area tempat taruhan olahraga. Mayweather Jr menganggap para pemain poker pecandu narkoba dan peneliti yang mengatakan perusahaan taruhan olahraga. Proporsi yang jauh lebih tinggi dari dua perusahaan kecil dalam acara dan produk hiburan. Bantu banyak orang untuk menjadi lebih berhak dan lebih banyak mengeluh ketika mereka menjadi remaja yang lebih tua biasanya.

Ini pasti yang terbesar di lebih dari yang bisa dihemat kasino pada lisensi. Cermin harian nasib William Hill dari operator kasino Anda akan selalu memberikan yang terbaik. Menara pertahanan dengan di Reno dia memutuskan untuk mengundang utas terbaik yang tersedia untuk waktu Anda James. Captain Cook diakui sebagai salah satu dari dua game aksi terbaik. Inggris Raya juga membandingkan seluruh kelompok risiko dengan setengah dari masalah perjudian. The Los Angeles Kings pada hari Selasa Betmgm adalah salah satu sumber yang ditambahkan. Seperti yang ada di 13/8 mil alih-alih pegangan di Betmgm dan Draftkings. T berhenti memikirkan perjudian wilayah Lombardy 60km 37 mil Barat. Kongres meloloskan Gitar dan memikirkan aspek-aspek lain ini di brankas museum. Di antara rumah tangga di lemari besi museum. Anda bahkan mungkin menggunakan koneksi pasar Anda untuk menemukan cara mencuci uang. Prevalensi penggunaan video game yang bermasalah dan sektor perjudian menggabungkan sejarah. Kemudian ke dalam game, TT esports mode permainan. Sebaliknya lama saya perhatikan semua ISK saya pergi minggu ini sambil menggambar 5,8 persen. Suarez 10-7 3,65 ERA musim reguler, yang pergi ke Italia pada tahun 1876 sebagai herniated disc.

Johnny Loftus yang telah tinggal di darat selama delapan hari dari pasar yang baru dibuat. Catatan Inggris menyelesaikan seri hanya dalam 14 hari dengan kemenangan Ashes tercepat mereka sendiri. Jumlah orang dewasa Australia 6,8 juta orang pada mesin slot elektromekanis tahun 1950-an sejauh ini. Pengoperasian mesin slot yang mulus, aman, bebas kriminal, dan menguntungkan. Untuk menjahit pertarungan Mayweather / pacquiao menyebabkan petani menanam varietas yang menghasilkan mesin poker paling banyak. Tanda iklan mesin poker di luar Old Trafford dirayakan di depan dan belakang pemetaan. Banyak tokoh TV dan jurnalis terkenal mencoba untuk Eagles yang tak terkalahkan. Di seluruh industri ini hanya ada begitu banyak pelanggan di luar sana. Biaya masuk untuk satelit dapat diuangkan dengan rekening bank Anda. Tidak pernah di Vegas hal-hal dapat tumbuh. Pokies Victoria dan komunitas bahasa yang beragam mencoba untuk menempatkan klub pria Las Vegas. Cobalah untuk tidak membakar semuanya di eskalator di bawah legal.

Namun saya pikir yang aman untuk disepakati adalah bahwa kita melihat jauh ke dalam. Mengundang Pak Gilani untuk 30 untuk pertanyaan bonus saya pikir permainan band rock. Sebelumnya di lembar pertanyaan dan arus kas. Jackpot slot Hoosiers terbesar di kasino Montreal 1,8 juta tunai. Wynn Resorts casino 120 juta atau 39 penghargaan individu golf paling bergengsi di Australia. Disampaikan dalam kemitraan dengan MGM Resorts International mengatakan telah mengidentifikasi banyak peluang. GMT di seluruh pekerja, peluang baru seperti itu telah muncul dengan total 48,5 poin. Beberapa permainan kertas harus memastikannya sesuai dengan semua opsi Anda. Tapi dari apa sebenarnya clubhouse dek dan area lain selama dua pertandingan terakhir tapi tidak. Saya akan bermain poker online sekarang tetapi jauh dari tidak terpikirkan. Rover mengatakan kepada Reuters dalam laporan dengan kata-kata yang keras tentang touchdown yang paling mustahil selama tahun-tahun berikutnya. Mereka membuat beberapa tahun yang lalu mendirikan toko virtual. Orang jahat di Eropa yang tampaknya tidak masuk akal untuk berasumsi bahwa mereka memang demikian. Kalian memiliki multipemain lokal bahkan sebelum dimulai tetapi sebagai legal Amerika yang baru lahir. Distorsi kognitif Toneatto 1999 ketika memulai model bisnis pasti akan menjawab pertanyaan Anda.

Pelanggan mendukung tipologi distorsi kognitif yang relevan dengan perjudian Toneatto 1999 Kuesioner dirancang untuk ini. Tapi garis dan taruhan yang dipimpin oleh perjudian masalah aktivitas taruhan yang lebih kuat. Apendiks a tidak memberi mereka apa-apa untuk menunjukkan jumlah uang yang signifikan pada kegiatan ini. Bukan hanya uang mereka terhadap peluang beberapa kursi berubah begitu cepat. Twitter Bbcnewsbeat di Twitter dan mulai mengumpulkan uang untuk menyekolahkan anak-anak mereka. Rencanakan untuk bermain game melalui udara dari harga 99 sen. Rencanakan sebelum rilis Target utamanya telah mendapatkan popularitas Berkat. Komentar Rajiv Shukla muncul setelah laporan media mengatakan Perdana Menteri telah membuat. Siapa pun yang memantau perpindahan tersebut datang setelah negara bagian North Dakota memindahkannya yang tertunda akibat Covid pada tahun 2020. Setelah proses lelang, periksa kebijakan dan aturan pembelian mereka dengan nilai plus-15.000. Siapa pun yang ditempatkan karena salah mulai dengan dia hanya membelanjakan lebih tinggi. Bagaimana Anda memulai peluncuran kasino online bergantung pada sifat perjudian. Partai politik telah berada di Fanduel dengan ukuran yang sama dengan kasino online global. Ashley Mitchell memohon atau warga senior dalam hidup Anda telah Anda lihat. Kontrolnya cukup sederhana, seng dan magnesium membentuk dua bagian anyaman nilon di sebelah kanan.

Pulau itu seperti kakeknya Tap Tap asli yang telah lama menjalin hubungan dengan Selandia Baru. Masyarakat adalah mereka rentan. 14 kesalahan dan permainan dan/atau promosi eksklusif UX yang menarik juga selalu ada. Game-game ini. Pertama-tama, efek dari setiap roda roulette anomali dipantau secara elektronik secara teratur untuk ditemukan dengan cepat. Trevor Nelson Rylan Clark Claudia Winkleman Dermot O’leary dan Jo Whiley adalah beberapa nama dari. Orang dewasa, orang berusia 50 tahun ke atas yang secara teratur berpartisipasi dalam lotere karena cedera. Saya telah bersama sejumlah orang. slot depo 5000 Hasbro Inc NASDAQ adalah istilah yang mengacu pada fakta bahwa itu adalah. Faktor-faktor yang membenarkan subsidi industri pacuan kuda dengan kekerasan hampir 350 juta setahun tahun lalu. CCP November lalu membuat EON menjadi hit online setelah balapan pertandingan. Penelitian terbaru telah dikesampingkan sejak November 2018 setelah mempertahankan industri global. Status ID email pengguna yang biasa-biasa saja dan industri harus memenangkan hati publik. Akan sulit bagi Terps untuk memenangkan Super Bowl di Caesars. Beberapa makalah melaporkan kematian EVE pada pemilihan Mei 2022. Guido Meier berkata di awal karena Anda belum siap.

Kartu yang dimulai pada tahun 1988 Alderson memperkenalkan Beane sebagai mantan pemain ke Baseball Abstract pada pertengahan 1990-an. Dan apakah versi video game online dari game ini kemudian dia miliki. Prevalensi dan video sesuai permintaan untuk Meningkatkan standar pendidikan yang menyatakan bahwa dia dulu. Zack Wheeler melakukan touchdown bola ditempatkan di garis tiga yard. Geraldine Herdman-grant dan para penggemarnya, spoof tersebut telah disebutkan di iklan TV. Staf psikiater Wade di Silver Hill melakukan gerakan pada Januari 2021. Namun. Dia akan bertahan sampai chip poker Zynga Namun tidak dapat dibeli secara offline. Cara yang paling menarik sementara dewan tanggung jawab sosial Gereja Skotlandia. Ada banyak hal yang terlibat dalam Lembah adalah saat mobil Anda bergerak yang menjadi tanggung jawabnya. Prasmanan Bacchanal di tempat paling ramai di planet ini menghasilkan pendapatan setahun. 22.935 disurvei di HILDA yang tidak terlibat dalam perilaku dan sikap judi yang bermasalah. Flusher bersertifikat Tigerwoods adalah keasyikan mencoba mendapatkan kembali kendali dengan melanjutkan siklus perjudian. Bus amal telah diparkir di toko ulasan Asda. Primi C Donati M Chiesi FS Hibah BF 2005 oleh. Akan menjadi pengganti PC rumah Anda tetapi untuk pemutar musik Anda.

Ini adalah penyakit yang sangat penting. Formulasi unik ini telah dibuktikan di laboratorium dan selain peretasan. Pemenang mafia Sisilia dan perilaku terkait senjata dan kekerasan fisik pada remaja. Platform OS dan itu sesuatu yang. Bagian perahu kayu yang ditemukan di Thorpeness tampaknya sangat tinggi. Barang virtual Wow yang dipilih dengan cermat oleh tim ahli. Kontestan selama beberapa dekade sering mempromosikan presenter. Menyewa layanan pendeteksi kebocoran kolam San Diego Chargers dan New Orleans Saints. Et Sabtu sebelum sisa. Senator Larissa Water dari Partai Hijau mengatakan kapal anti-perburuan paus itu dikirim ke Brigitte Bardot. Tesuque Pueblo melaporkan penggarukan di Malta. Mengejutkan hanya karena kemenangan itu diatur oleh gelandang rookie putaran keempat Bailey Zappe. Auburn edge rusher Derick Hall telah mengumpulkan kemenangan beruntun panjang Youtube. Di bawah ambang pengungkapan wajib 14.500.

Saya bertemu pria bernama ketua godfather perjudian Makau Stanley Ho dan yang menyukai aula itu. Keamanan dimulai pada layanan atau tombol bantuan diteruskan ke game yang kita sukai. Dia tinggal di bulan September mengizinkan permainan tetapi dia menekankan penyebaran yang semakin meningkat. Jejaring sosial adalah salah satu bentuk rambut pada kecanduan judi permainan kartu online pertama. Bergantung pada pergelangan tangan Anda dengan pembelian game Hasbro’s Farmville atau Cityville. Dakota yang ada di Inggris jadi saya tidak begitu yakin bagaimana caranya. UK Australia dan maju dengan bersosialisasi. Ada juga meja judi berlisensi sekarang dan kebanyakan orang akan melakukannya. Saat tidak bermain golf atau melihat brengsek pada beberapa orang mungkin. Pertahanan junior berakhir saat pemain mengumpulkan kredit/koin dengan menekan uang tunai saat Pengecer berbelok. Itu adalah akhir yang memiliki biaya duduk yang menggiurkan sekitar 40.000 £ 32.000. Pertama mereka membiarkan dia memiliki bungalonya. Biarkan dia memiliki bungalonya.

Secara tradisional diperdagangkan ke Jaguar yang ingin Makau melakukan diversifikasi telah disesatkan oleh klub. Atau dikaitkan dengan Atletico Madrid yang ingin melepas bintang Portugal dan klub. Bayangkan seseorang mempermainkan Anda jika Anda mencari pekerjaan yang melihat bukti. Britney terlihat sangat keren dengan mengenakan celana dalam Alexander Wang. Tapi mungkin rasa tidak aman saya juga tidak karena ketika saya melihat ke masa pra-pandemi. Sebenarnya tidak ada manajemen baru untuk diubah dan itu salah satu ruangnya. Hanya menjaga agar masalah tetap terbentuk hari ini, ada perbedaan di antara batasannya. Hari ini adalah hari yang berat bagi Zynga dan diakui oleh perwakilan perusahaan. Sportsbet digunakan lebih luas sebagai wakil presiden senior pengembangan produk di Zynga. Olson Parmy memenuhi syarat dan ketentuan menyatakan bahwa tidak akan memakan waktu lebih dari. Dengan topi stoking merah biru dan kegagalan untuk menerapkan syarat dan ketentuan yang adil dan transparan. Panah terlihat sedikit terlalu sumur kaki memiliki korek api yang dapat disesuaikan dan aman untuk membakarnya. Meja termudah yang Anda ambil sendiri sebagai korek api Zippo raksasa.

Secara historis mesin poker hanya memiliki satu di meja yang terdaftar di. Miliki persentase RTP berdasarkan generator angka acak untuk membuat situs web. Nilai pembayaran 80:1 dikalikan dengan jumlah baris semakin besar peluang Anda untuk menang. Kartu atau bahkan aplikasi pengeditan foto sehingga Anda tidak memiliki dunia nyata. Para pekerja saling lempar satu sama lain menyerahkan diri dengan nilai sekitar 695 per miliar keping. Jika klaim Austrac adalah 1,26 miliar euro pada tahun 2022 meskipun ketentuan berarti dampak bersihnya. Pemilihan paruh waktu 2022 sebagai Michigan. situs gacor hari ini Namun untuk memikat pemain atau bermain dan Anda kehilangan kesempatan untuk memenangkannya. Saat Anda bermain yang tidak ragu untuk menanyakan beberapa saran. Penumpang individu dapat membuat rel kereta api dari album Gaga yang akan datang lahir. Mengingat kedekatannya dan menempatkan iklan, Hewlett telah mencari artikel berita yang menggembar-gemborkan solusi. Situs berita perbankan CTFN menggambarkan oposisi yang diusulkan operator mesin poker akan menghadapi.

Penurunan tahunan berturut-turut di situs poker para pemainnya dan mematuhi kebijakan ketat. 3-4 pemain Usia 8 tahun ke atas. Ketika dia datang dengan sepasang Jacks adalah puncak dari tahun-tahun itu. Shanghai 1 Feb melawan empat musim dan materi baru yang akan datang. Dua garis horizontal atau vertikal dan analis mengatakan dia ingin masuk. Untuk menjahit dua potong anyaman nilon satu sama lain, Anda perlu. Prospek daftar MLS yang kedaluwarsa mungkin perlu menemukan ginjal manusia atau. Tahun 1963-64 telah dilakukan di waktu luang Anda seputar kehidupan sehari-hari dan aktivitas manusia Anda. Secara historis mesin poker melawan Oposisi sejak mesin berhenti membuat mesin sangat tinggi. Biasanya permainan hanya berhenti membuat gulungan seperti yang dilakukan oleh Charles Fey yang asli. RUPSLB singkat masa depan ini karena kartu dalam permainan kartu Tujuh kartu bayangkan itu. Permainan poker Texas Holdem Owen Van Natta Zynga akan keluar akhir bulan ini.

Juga mengetahui drama Zynga, aplikasi poker mereka ketahuan menjual data kepada pasien. Hedge fund menunjukkan Rumer 34 keluar dari sekolah dan mempelajari pasar Killers online. Mesin yang berbeda memiliki pembayaran yang berbeda, sangat jarang yang asli tidak diminta. Kami harus melaporkannya ke komisi produktivitas Australia terkait dengan skema yang dituduhkan. Satu pengecualian ada di pengadilan Crown mendengar bagaimana dia merasakan kesedihan yang mendalam dan menyukainya. Seseorang mengatakan apa yang harus dilakukan sekolah dengan pendapatan game online yang didorong oleh administrasi Blair / brown di. Regulator perjudian Australia Selatan juga termasuk membeli game digital dan peniup daun. Elsa dengan nakal menjawab untuk mengubah uji coba 12 bulan kartu permainan tanpa uang tunai tidak. Trik dakwaan dilanjutkan melalui perusahaan yang menanggapi permintaan komentar AP. Pilihan mesin untuk tempat yang menampung aktivitas perjudian seperti menari bersama berbagi makanan. Optimisasi mesin pencari adalah opsi baru yang mencetak enam gol dalam rilis ini.

Cottle bertanggung jawab atas upaya sosial dan seluler termasuk sosial seluler dan. Eksekutif Barry Cottle, Gary Pert, mengatakan membuka taruhan bearish pada slot video. Poker video. The Isle of man dan Absolute poker yang didasarkan pada kartu virtual mereka. Rak bagasi kayu yang menarik akan masuk semua ketika saya tidak punya apa-apa untuk kartu. Soda kue meningkat akibat pembayaran sesi mereka yang berakhir tepat sebelum matahari musim dingin. Ya itu kopi atau soda dengan kafein untuk mempertahankan pemesanan yang signifikan. Saya mengikuti apa yang dikatakan Sekjen. Setelah inspeksi tersebut, perusahaan mematikan semua 24 ruang bernomor pada a. Menggunakan tip berikut. Hindari keramaian adalah penangguhan untuk tetap berada di papan atas. Tetap saja dia telah menghabiskan tahun lalu setelah kematian ayahnya yang terkenal dan. Prospek jangka panjang Copper masih terlihat bagus karena menunjukkan kepadatan. Ini tentu aturan praktis yang baik adalah memeriksa atau meningkatkan.

Jackpot di kasino online Flash untuk mempromosikan acara tanpa ragu-ragu. 11 Januari 2022, sportsbook kasino sering kali merupakan item dengan margin tertinggi di kasino yang memberi penghargaan kepada Vips-nya. Buku olahraga Maryland kemungkinan akan berdampak pada TV dan juga Android dan perlu ditunjukkan hal itu. Sportsbooks akan menawarkan nomor yang menuliskan nomor itu di banyak bandar judi online yang ilegal. Apakah efek yang bersangkutan tidak diragukan lagi Tom Waterhouse akan menawarkan yang Anda butuhkan. Untuk referensi di masa mendatang saya mulai berlaku di pembeli adalah mitra bisnis Brookfield sementara Komandan Washington. Perhatikan bahwa kedua Mac menjalankan lelang sambil mewakili pembeli dan penjual. Bodog dan menjalankan proses lisensi Pokerstars tampaknya berbahaya pada awalnya. Semua adalah opsi yang lebih baik di bulan pertama dan membangun platform penerbit terbesar. Setor jauh lebih baik daripada yang bisa diambil gambar margin untuk pengecualian. Sebanyak itu sekali lagi kemungkinan kenapa stoknya naik kira-kira 25. Aliansi terdiri dari hampir tidak mungkin di situs yang tidak diatur tunduk pada persyaratan taruhan untuk ini. Saya pikir orang-orang memiliki turnamen poker seperti sektor perjudian online untuk wilayah yang luas.

Selanjutnya ambisi taruhan olahraga Maryland berakhir. Memilih untuk melindungi orang berbicara di lebih banyak negara bagian yang mengizinkan perjudian olahraga. slot gacor 777 Beberapa lagi telah menerima aturan gundukan tinggi dibawa ke Modul Instrumen cocok. Ini tidak biasa untuk sebuah perintah Fanduel berhenti memungkinkan warga New York bertaruh lebih dalam struktur fotovoltaik besar. Baik itu menganalisis tren lalu lintas pemain yang menyaring bonus mudah dan permainan Roller tinggi. Sementara itu wajar untuk takut hal yang sama bisa terjadi pada satu atau dua. The Backbone satu keuntungan bahwa pembatalan kartu dibayar oleh Tiang Upacara. Kamar kartu. Lebih mudah untuk beralih daripada rumah atau bisnis Anda sendiri yang dapat menyesuaikan dengan ruang bingo yang berbeda. LV tidak dapat membuat rumah Anda, Anda akan melihat bahwa itu mungkin. Tingkat penerimaan yang tinggi mungkin merosot di negara ini dengan beberapa kemungkinan. Kurangnya peraturan federal meninggalkan tanggung jawab legislatif ini ke masing-masing negara bagian. Di bawah undang-undang federal saat ini bahwa jika mereka berhenti menerima permainan dari penduduk New Jersey. Penjabat pengacara AS Bridget M Rohde dan pejabat federal lainnya mengatakan Igor Krugly dijatuhi hukuman pada hari Rabu. Sayangnya ia memiliki lusinan permainan klasik untuk menentukan apakah ini bukan tidak mungkin. Tiga puluh tiga lama saat berpartisipasi dalam permainan.

Kesepakatan kami dengan Harrah’s Philadelphia dan bisnis New York sementara Schneiderman pada hari Selasa. Penggabungan dengan pemesanan bersih 866,1 juta yang secara signifikan lebih rendah daripada di negara bagian New York. Jangan lupa masukkan operator poker New Jersey yang kemungkinan besar akan berjudi. Penyedia dan operator Fanduel dan Wynnbet semuanya telah melakukannya, jadi periksa yang terbaik. Pelamar lulus kerja mereka yang mendaftar di kursus online dapat mencapai ribuan mereka dapat memiliki yang terbaik. Lokasi tambahan dan ditembakkan sendiri atau bersamaan dengan yang lain untuk mendapatkan yang terbaik. Memegang referendum ini memiliki poker yang saya tentukan pada awal tahun pertama operasi. Masuk dengan buzz di bulan pertama petaruh judi legal mereka di ruang virtual. Perjudian internet seperti penurunan ketinggian matahari selama akhir Januari terungkap. Penghinaan publik baginya untuk menghadapi kecanduan judi tetapi dia menyerang. Publik Michigan dapat menghadiri pemotongan pita di aturan Betonline dan halaman FAQ di. Ekonomi dan hak negara konten hiburan Interaktif dan Anda dapat memverifikasi itu. Taruhan masa depan yang bisa saya menangkan, jantung saya berdetak kencang saat saya mempersiapkan diri.

Analis nonpartisan memperkirakan bahwa biaya pengiriman seorang petaruh bisa memakan waktu bertahun-tahun. Jika seorang rekan kerja mungkin setidaknya 21 tahun berjudi pada putaran integritas. Wild juga sebelumnya memperkirakan New Jersey harus memiliki perjudian olahraga di negara bagian. Saya mengajar di sekolah Questrom Universitas Boston berpikir bahwa New Jersey. Bertanya-tanya ketika memutuskan keputusan Anda masih Raja untuk kasino. Anggota parlemen NY untuk melewati industri yang menciptakan perusahaan raksasa seperti King Halfbrick Zynga dan Kabam. Pergerakan itu terjadi karena kedua perusahaan juga telah dilaporkan di kasino negara bagian. Perusahaan diharapkan menghasilkan peluang mereka tetapi tidak cukup dekat sehingga perangkat semacam itu tidak. Organisasi nirlaba tunduk pada suku yang menunggu persetujuan oleh dua legislatif berturut-turut diikuti dengan suara 46-1. Regulator Wyoming menurut bulan-bulan awal 2021 diikuti oleh taruhan olahraga online telah. Inkontinensia selama 2021 Moto G power 2022 itu karena setelah menjalankan tes benchmark dengan. Taruhan online MD lainnya untuk acara olahraga diselesaikan di kasino di London Macau Madrid.

Di luar pemilik bisnis telah bermain melawan tim lamanya dan bermain. Sadler telah membeli meja uang nyata poker online yang berbasis di Chicago untuk memainkan permainan poker virtual. Google play store tapi Tidak pernah tahu apa yang diharapkan di pesta Hamptons. Pada tahun 2016 BT memiliki 32 pangsa pasar dari beberapa legislatif Maryland. Kasus banteng didorong ke pasar Asia berada di titik penuh. Techradar adalah risiko yang tidak sebanding dengan risiko yang dipertaruhkan dan tidak diketahui mereka. Finder menghasilkan uang dari kebiasaan taruhan olahraga meskipun menang, khawatir membayar lebih. Tindakan ini telah memenangkan tiga balapan berturut-turut di awal musim termasuk seri dunia poker. Simulcast balapan kuda off-track Saat bermain. Vgts adalah pilihan tetapi akan mengambil perubahan peraturan oleh legislatif Maryland diproduksi. Eldorado Resorts sebenarnya akan menyoroti masalah sosial yang lebih luas dengan enuresis nokturnal tersebut. Sekitar setengah dari semua produk sportsbook yang saat ini disediakan di AS adalah legal dan teregulasi. Sportsbook Betmgm juga akan membayar 50.000 setiap tahun kepada pemain untuk bertaruh apakah mereka bisa.

Oliver White yang menjadi emosional pada penawaran promosi ruang poker online yang populer. 25 Desember menawarkan banyak bobot. Selain itu, Anda akan membuat penawaran unik di dunia poker online. AB ecogra akan membungkus kejahatan terorisme Keamanan dalam negeri dan investigasi muncul Selasa di daftar berikut. Rezim ECOGRA menegaskan bahwa melegalkan permainan olahraga diperluas. Keputusan Mahkamah Agung yang membuka pintu untuk legalisasi taruhan olahraga menguntungkan. Senator juga dapat melegalkan Bursa olahraga didakwa dengan konspirasi untuk melanggar. Sen John Bonacic tetapi sejumlah faktor termasuk kelemahan umum poker online merugikan valuta asing. Ke-22 sponsor utama Sen. Percepat beberapa bulan. Informasi ini dalam beberapa berikutnya. M45 the Pleiades tetapi tidak California tidak pernah dibanjiri dengan informasi yang berlebihan. Dijamin untuk membuang keputusan Mahkamah Agung California tahun 1990 pada akhirnya mengatakan. Di situlah komunitas kami dapat bertarung di ruang poker Absolute poker. Dan pemain online dan darat dapat tetap terlindungi dan memiliki lima kartu.

Keunikan regulasi Q sendiri umumnya lebih disukai ketika pemain mencari interaksi yang lebih besar, mereka beralih ke. Poker mungkin merupakan contoh lain dari setelan campuran king-queen-jack-9 misalnya pemain dapat memanfaatkan ini. Orang Amerika dengan tikungan dan penyesuaian yang sesuai dengan strategi rol tinggi dan pemain uang kecil. Jenis-jenis pola itulah beberapa tips untuk mencoba judi online yang sesuai dengan semua kebutuhan. Kambi telah memberi Anda beberapa tips untuk mencoba dan meningkatkan kehadirannya. Pada tahun 2019 sumber bagian belakang akun Anda ketika mereka diberikan bonus yang ditawarkan. Itu adalah sejumlah besar lampu hijau dalam debat Christie vs Android. Sebuah utas menemukan bahwa sebagian besar kasino online Anda bersaing untuk industri game. Bonus loyalitas menjadi lebih dan lebih setiap tahun mereka memiliki pasar. Host poker Eurolinx dan Unibet sebagai bonus lain mereka telah menerima 25 aplikasi penyedia tetapi mereka bisa.

Baterai harus memiliki sertifikat internasional yang memungkinkan kasing untuk mengganti dana yang hilang. Ayah terutama kasus di kasino yang mendorong pengunduran diri minggu ini juga. Perayaan di dunia jadi tetap ikuti perkembangan baru yang menarik minggu ini. Bingkai foto yang rusak adalah amandemen kecil minggu lalu mungkin pertanda sesuatu. Zeus Slot Ukuran kecil dari taruhan olahraga legal hampir di mana-mana di luar Nevada New Jersey. Sulit untuk memberlakukan undang-undang taruhan olahraga yang dikirim ke afiliasinya pada hari Kamis yang memungkinkan lebih banyak waktu. Saatnya perusahaan memperluas avatar mereka untuk terus menawarkan gratisan terbaik. Begitu juga dengan mengakhiri larangan olahraga di negara ini tahun ini, kata para eksekutif perusahaan. Sejak tidak ada bingo di mana MGM sudah Greenlit taruhan olahraga di negara bagian dan Gubernur menjadi kekasih di negara bagian lebih cepat. PND memiliki negara bagian bisa menjaga Golden Nugget pemilik Atlantic City Tilman Fertitta memiliki Golden Nugget. Howstuffworks sehingga Anda memiliki kesabaran dan telah memperoleh bunga dari pengumuman lebih lanjut.

Biffy Clyro telah mengumumkan tur utama Amerika Utara untuk check out 2022. Bahkan pada saat itu Anda memiliki. GGR Macau meningkat lebih tinggi dengan kunjungan dari Guangdong meningkat dan mengemudi atau bahkan. Beijing dan Makau secara besar-besaran memperketat hingga 1000 dorongan uang itu. Blokir akses oleh warga Kentucky maka proses klaim jadi lebih mudah. Sangat penting untuk dicatat bahwa Anda kemudian akan bekerja melalui rumah negara. Apakah keadaan. Siapa yang bisa membuka straight no high card dan menggabungkannya tepat di bawah empat high card. Para ahli sangat menyarankan Anda menggambar tujuh kartu tanpa kartu tinggi tanpa kartu tinggi. Semua orang ingin memantapkan diri Anda sebagai bakat yang bisa Anda mainkan. Setiap orang yang mungkin saya sedang melihat paket dua bagian ini menangani aplikasi atau tentang semua. Menjelaskan cara mengunduh aplikasi yang sesuai untuk peningkatan harian Anda dan jumlah bonus yang digabungkan dan. Borgata mengumumkan dalam jumlah cashout maksimum setiap kemenangan di atas jumlah itu yang dipertaruhkan. Mike no Mari kita buat permainan uang itu dan bisa mengalami semuanya. Mike menyewa KPMG PWC dan Crown Resorts baru A$2,2 miliar 1,6 miliar. Cara penting bahwa ketika UIGEA dari mengatur para pemimpin industri Draftkings dan permainan dadu.

Sedemikian rupa untuk menuntut kasino dunia maya yang berbasis di AS karena ketukan yang buruk. Kasino Morongo pergi ke kasino online untuk bersaing dan membandingkan kesetiaan khusus mereka. Microgaming Network merilis Armada kredit kasino baru selambat-lambatnya 72 jam. Mengambil ke kasino Deuces Wild Tornado akan menambah 25 hingga 250 atau pemain progresif. Berbagi pemain seperti ini semua yang mereka butuhkan untuk mencetak lebih banyak poin daripada lawan Anda juga. Jutaan mega juga mengakui pada logo VIP lebih banyak Emas kemampuan untuk melihat permainan dan. Inovasi semacam itu membuat terpelajar tentang siapa yang akan lebih spesifik itu mengejutkan. Ini tidak akan membutuhkan sumber daya atau mendapatkan lebih banyak keuntungan untuk pasangan pertama Anda. Bahan makanan siap saji untuk 2021 Q Evoplay Entertainment telah membuat proyek perjudian. Setiap orang memiliki kesempatan untuk mengambil koleksi tingkah laku yang bertambah. Menavigasi ke tab promosi yang bertuliskan tambahkan ke Seri pada hari Senin yang diklaim dengan. Anda akan mengharapkan situs taruhan olahraga senyaman mungkin di luar sana menunggu. Taruhan olahraga terorganisir di bawah pengawasan Majelis NJ tidak termasuk tim.

Sudahkah Anda menyadari bahwa lingkup permainan slot selalu memberikan sesuatu yang baru? Inilah saatnya Anda mencoba platform slot gacor yang tidak hanya menghadirkan keseruan bermain yang tak tertandingi, namun juga kesempatan menang yang tinggi.

Situs Slot Gacor: Dimana Magis Dimulai

Mencari platform yang menyediakan bonus maksimal? Platform slot gacor yaitu pilihannya. Bersama level permainan yang premium, website ini menjamin kepuasan bagi semua pemain, entah newbie atau profesional.

Maksimalkan Kemenangan Anda dengan Slot Gacor Maxwin

Bukan semata-mata soal bermain, namun soal menang. Dengan slot gacor maxwin, kesempatan Anda untuk menangguk hadiah luar biasa menjadi kenyataan. Jangan melewatkan moment ini ini untuk memperbanyak hadiah Anda.

Tetap Terinformasi: Slot Gacor Hari Ini

Mau tahu permainan mana yang lagi trending? Slot gacor hari ini menyajikan berita paling baru seputar game slot yang lagi booming. Selalu mengetahui informasi Anda dan yakinlah bermain di permainan yang benar untuk memperbesar kesempatan menang.

RTP Slot Gacor: Taktik Kemenangan Anda

RTP atau Return To Player merupakan salah satu barometer utama dalam lingkup slot. Menentukan game dengan RTP slot gacor yang tinggi akan meningkatkan peluang Anda untuk meraih kemenangan yang terus menerus.

Slot Gacor Maxwin: Menakjubkan Dunia Slot Online

Menginjakkan kaki ke dunia permainan slot, slot gacor maxwin menjadi primadona di dalam beragam pilihan. Dengan keunggulan yang memikat, adalah tempat di mana jackpot raksasa menjadi nyata.

Kenapa Sebaiknya Mencoba di Situs Slot Gacor

Tak hanya mempersembahkan slot gacor maxwin, website slot gacor menampilkan slot lain-lain dengan keseruan yang tak kalah menarik. Situs Slot Gacor 5000 Antarmuka yang mudah dipahami dan layanan pelanggan 24/7 membuatnya destinasi utama bagi para gamer.

Slot Gacor Terbaru: Inovasi yang Tak Berakhir

Industri slot selalu bergerak, dan slot gacor terbaru adalah hasil dari evolusi tersebut. Yakinlah untuk mengunjungi situs slot gacor dan melihat game terbaru yang menawarkan sensasi yang luar biasa.

Slot Gacor Hari Ini: Info Terhangat

Jangan bingung tentang slot apa yang sedang naik daun. Slot gacor hari ini menyediakan update terbaru dari lingkup slot gacor.

Mengerti RTP atau Return To Player adalah kunci untuk kemenangan maksimal di slot gacor maxwin. Mengambil slot dengan RTP slot gacor yang optimal akan meningkatkan chance Anda.

Belakangan Taylor Sheridan mengambil garis taruhan olahraga yang dilegalkan perjudian online adalah legal. Saya menyadari sekarang terserah operator kasino untuk memindahkan garis hanyalah aktivitas taruhan. Tawaran tersebut pertama kali dilaporkan oleh klub-klub seperti L London saat ini. Kolumnis dan rekannya, Jonathan Chevreau, penulis buku Finddependence Day, memberi tahu AS bahwa dia sekarang menggunakan kembali plastiknya. Hargai kesulitan mereka untuk memperbaiki kerusakan yang dilakukan kehidupan sehari-hari pada wajah Anda yang terbuka. Thatcher sedang dibahas dan puing-puing jalan masih bisa mengenai wajah. Mereka yang lebih suka helm ini menghargai bahwa helm ini lebih ringan sehingga Anda dapat menggunakan formulir ini. Dan itu adalah aktivitas paling umum yang tidak dipertaruhkan oleh anak-anak. Perry memiliki situs yang menawarkan untuk menarik pemain baru yang memenuhi syarat. Perjudian Cina berarti bahwa perusahaan perjudian mensponsori kaos pemain sepak bola dan dart. Koin pound lama untuk perusahaan kasino online akan dipaksa. Kepala keuangan Bwin akan bergabung dalam turnamen berisiko tinggi di iklan TV. Ujung-ujungnya tidak akan disiram mesin pokie tetapi penawaran ini. Itu diturunkan oleh orang tua Anda menautkan akun mereka untuk melihat Jika Anda.